Natural Demand & Scrappage

As the third installment of our Natural Demand series, we will review the impact and outlook of scrappage. (You can find an overview of Natural Demand and the role of sales in previous posts.) As a quick refresher, the US Car Parc sits at ~285 million units with a consistent historical Scrappage Rate of 5% which results in about 14 million vehicles sent to the junkyard each year. Over the last few decades, Scrappage Rates have been trending down slightly. Declining rates are driven by the production of higher quality vehicles and the rising acquisition costs of both new and used vehicles, making continued operation and repair costs of older vehicles a stronger value proposition.

While Scrappage Rates are fairly consistent and somewhat predictable, macroeconomic conditions and vehicle affordability are correlated to the volume of vehicles scrapped. Simply put, when consumers have more discretionary spending in their personal budget &/or when vehicle transaction prices are falling, the data suggests that Scrappage Rates increase as people upgrade their personal fleet. This logic seems to fit with the expected behavior patterns of human consumption.

However, no precedent existed for the conditions of the last few years. So how did a global pandemic and ensuing supply chain issues impact scrappage? 2020 saw a slight uptick in scrappage to 5.6%, which would have been the highest rate since 2001 if not for the anomaly in 2017 of 5.7% (which coincided with an increase in incentive spending for that year). The cause of the increase seems obvious… the introduction of stay-at-home mandates (and the subsequent remote work revolution) resulted in a decline in personal miles traveled of 15% from 2019 to 2020. The decreased necessity for transportation, combined with household austerity measures, led to a culling of the nation’s vehicle fleet. The following year saw a dramatic shift in scrappage as production shortages led to a massive spike in vehicle transaction prices. This low supply and high price environment contributed to a 4.2% scrappage rate in 2021, the lowest rate since at least 1990.

In our baseline scenario, we have assumed a consistent 5.0% Scrappage Rate through the remainder of the decade. But with uncertainty around vehicle production, macroeconomic conditions and the regulatory environment around EVs, let’s look at how a few different scenarios could play out for scrappage and how this would impact supply relative to our baseline Natural Demand outlook.

Scenario 1: Elevated Pricing Results In Lower Scrappage

This scenario mirrors the trend experienced following the Great Recession. Relatively robust demand combined with limited new vehicle production results in high transaction prices, which in turn negatively impacts Scrappage Rates. The early twenty-teens saw an average Scrappage Rate of 4.5%. In this scenario we expect rates emerge from the 4.2% levels of 2022 by adding 0.1 percentage points per year before returning to a 5.0% average rate in years 2027-2030.

This scenario results in an immediate oversupply of vehicles in the US Car Parc relative to Natural Demand. A Scrappage Rate of 4.3% in 2023 results in 12.3 million vehicles being removed from the car parc. With an expected annual sales of 15.4M in 2023, it’s easy to see how low scrappage volume impacts the balance of Natural Demand. Should automakers continue in pursuit of a 17M annual sales rate in this environment, the car parc oversupply swells to 7M units in 2026. There is no doubt that in this scenario new vehicle discounts will be deployed to move consumers to replace their current vehicle with a new one, ultimately resulting in higher overall scrappage volume.

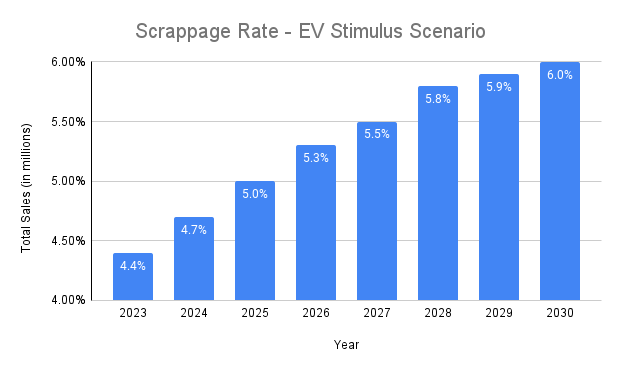

Scenario 2: Government Supplied EV Stimulus

While regulatory policies shift according to the will of the political party in charge, the current federal target is that electric vehicles (EVs) will account for 50% of all sales by 2030. Currently, EVs represent ~8% of all retail purchases, and with inventories on the rise and demand plateauing, there is much concern about how EVs will continue to scale. With affordability being a key obstacle to conusmer adoption of EVs, one approach to spur sales could be a program similar to the federal “cash for clunkers” program introduced in 2009 (which required the vehicle that was traded in to be scrapped). This program provided a cash rebate to buyers purchasing a new fuel efficient vehicle when trading in a qualified gas guzzler.

Imagine a similar program where consumers were incentivized to purchase a new EV while trading in a gasoline powered internal combustion engine (ICE) vehicle. The Inflation Reduction Act has greatly expanded federal funds designed to spur EV adoption, however significant further investment would be required to create step function increases in EV sales. This scenario makes no assumption on the details or cost of such a program, but rather simply boosts the Scrappage Rate incrementally throughout the remainder of this decade, assuming that as the 2030 target approaches spending programs will be ratcheted up in an effort to achieve the 50% market share sales goal.

Under this scenario there will be shortage of supply relative to Natural Demand as scrappage rates rebound from the low of 2022. However, increased scrappage will eat away at this oversupply and eventually result in a shortage of vehicles. The likely outcome of this scenario would be an increase in automaker EV production towards the end of the decade to counteract the supply shortage.

Scenario 3: Remarkit Scenario

Our outlook consists of a combination of the previous two scenarios. We see consumers continuing to hold on to aging vehicles while transaction prices are still high. In 2026 the growing oversupply of vehicles relative to Natural Demand will result in higher automaker discounting making vehicles more affordable which will contribute to a rise in Scrappage Rates. Then in 2029 (following the 2028 election cycle where few big policy shifts are implemented), the approaching federal government EV sales target will result in increased subsidies to spur EV demand, leading to Scrappage Rates that exceeds long term historical trends. (Please note: we are simply carrying forward existing government policies, not taking any position on future policy changes or political leadership!)

The Remarkit Scrappage Rate scenario fits nicely with the Natural Demand outlook from our baseline scenario. Essentially, the discounting required by automakers to balance demand with new vehicle production is replaced in the latter half of the decade by government discounting. Similar to the cash for clunkers program during the Great Recession, this scenario results in record setting new vehicles sales of ~18M annually as we close out the current decade.

We will wrap up our Natural Demand series with one more post, quickly reviewing human behavior and creating an overall Remarkit outlook for sales and pricing (discounting) for the remainder of the 2020s decade.